Which of the Following Statements Regarding Adjusting Entries Is True

Which of the following statements is true. Accountants use adjusting entries to record explicit transactions at the end of each re.

Acg2021 Ch 4 Concept Overview Videos Flashcards Quizlet

Answered Which of the following statements regarding adjusting entries is true.

. Which of the following statements is true regarding adjusting entries. Adjusting entries are optional with accrual basis accounting. Adjusting entries involve at least one balance sheet account and one income statement account.

Adjusting entries do not affect the income statement. Adjusting entries are recorded for all external transactions. DNone of these statements are true.

Adjusting entries for revenues include a credit to cash. Adjustments are only made if cash has been received or paid during the period. Reversing entries are most often used with accrual-type adjustments.

Adjusting entries are done to post unrecorded business transactions. Group of answer choices A. Any boxes left with a question mark will be automatically graded as incorrect cash is never part of an accrual or deferral adjusting journal entry.

Adjusting entries always affect the cash account. Which of the following statements regarding the role of cash in adjusting entries is true. Adjusting entries have nothing to do with accrual accounting.

BAdjusting entries are dated as of the first day of the new accounting period. DAdjusting entries are usually recorded after the end of the period but are dated as of the last day of the period. Which of the following statements regarding adjusting entries is false.

15The adjusted trial balance is prepared. Reversing entries are dated December 31 the end of the fiscal year. Adjusting journal entries do not affect the cash account.

Adjusting entries are dated as of the first day of the new accounting period. Adjusting entries are made on a daily basis as cash is exchanged between parties. Accountants use adjusting entries to record explicit transactions at the end of each reporting period.

Adjusting entries are typically recorded on the last day of the accounting period. Debits are equal to. Expensing prepaid insurance is an example of an adjusting entry.

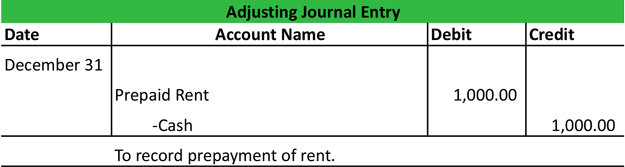

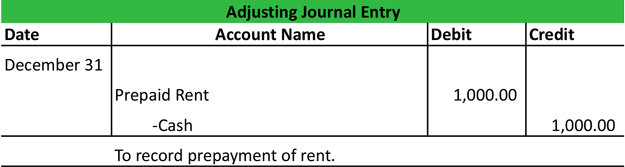

Adjusting entries for expenses include a debit to cash. 14An adjusting entry debiting Unearned Rent and crediting Rent Revenue is an example of adjusting an aprepaid revenue. Adjusting entries are typically recorded on the last day of the accounting period.

Adjusting entries are recorded to make sure all cash inflows and outflows are recorded in the current period. The adjusting entry for accrued revenues. You may select more than one answer.

Which of the following statements regarding types of adjusting entries is true from FINANCE BU383 at Wilfrid Laurier University. Reversing entries are required by Generally Accepted Accounting Principles. Which of the following statements regarding adjusting entries is true A from ACCOUNTING 1010 at Imperial College.

None of these statements are true. AAdjusting entries are optional with accrual-basis accounting. Looking for a Similar.

Multiple Choice Adjusting entries are recorded after the closing entries have been recorded. After adjusting entries are made in the journal they are posted to the ledger. Adjusting entries are needed because we use accrual-basis accounting.

Adjusting entries arise from the internal operations of the firm. Adjusting entries should be dated as of the last day of the accounting period. Aonly if errors are suspected when problems arise while preparing the financial statements.

CAdjusting entries are not posted to the ledger. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Which of the following is true regarding adjusting entries.

Which of the following statements regarding adjusting entries is true a from ACCOUNTIG 46452 at Bahauddin Zakaria University Multan. Debits an asset account and credits a revenue account. In laymans terms to accrue means to accumulate while to defer means to postpone.

Equal totals in a trial balance guarantees that no errors were made in the recording process. Adjusting entries are done to correct errors made during the month. Adjusting entries affect profit or loss.

YES After adjusting entries all temporary accounts should have a balance of zero. Debits a revenue account and credits an asset account. Adjusting entries are not posted to the ledger.

Debits a revenue account and credits a. Adjusting entries do not involve the cash account. Adjustments are needed to ensure that the accounting system reflects all revenues and expenses that occurred during the period.

Reversing entries are recorded before adjusting entries. Which of the following statements concerning reversing entries is true. Which of the following statements is true regarding adjusting entries.

Adjusting entries are made at the beginning of the accounting period. An explanation is normally included with each adjusting entry. An adjusting entry involves both a revenue and an expense.

Adjusting Entries Meaning Types Importance And More

Acg2021 Ch 4 Concept Overview Videos Flashcards Quizlet

Adjusting Entries Types Example How To Record Explanation Guide

No comments for "Which of the Following Statements Regarding Adjusting Entries Is True"

Post a Comment